How to file Income Tax Returns online? Income tax a form of direct tax imposed by the Government of India on both residential and non-residential Indians.

Individuals have an income of Rs. 2.5 lakhs / year are liable to pay income tax, usually within 31 August of the same year.

There can be various reasons for filing income tax returns even in the absence of income. A taxpayer wants to file his income tax return to report his income for a financial year, compensate for further losses, claim an income tax return, claim tax deduction, etc.

Income tax return is a form which enables the taxpayer to declare his income, expenditure, tax deduction, investment, tax etc. The Income Tax Act, 1961 makes it mandatory for a taxpayer to file income tax returns under various scenarios.

However, Income tax filing used to be a lengthy process involving several stages of documentation and verification. The Income Tax Department facilitates electronic filing (e-filing) of income tax returns.

Every single taxpayer (including organizations, firms, societies) is eligible for e-filing of income tax returns. The special provision reserved for super senior citizens (persons above 80 years of age), who can file their IT in paper or online format.

READ ALSO : Important terms of Income Tax return and Benefits of Taxes

Here are simple points How to file Income Tax Returns online as following.

How to e-file Income Tax Returns online portal Step by Step

A person wishing to complete income tax e-filing in India should be a registered user in the official website of the Income Tax Department, India.

1. Gathering necessary documents

A taxpayer must compute his gross taxable income and tax deducted at source (TDS) to complete the income tax filing in India.

For computers, some documents like Form 16, Pay Slip, Certificate of Interest etc. will be required.

Documents such as Form 16 are necessary for calculating TDS, as it serves as a TDS certificate provided by one’s employer if they pay income tax returns on their salary.

Financial institutions, like banks, also issue Form 16A if a taxpayer pays TDS on interest earned on savings schemes such as fixed deposits.

2. Downloading Form 26AS

Form 26AS makes a detailed calculation of all areas that taxed during a certain financial year. It deposited against a PAN card, and is available in the TRACES website.

It can downloaded by navigating to the ‘My Account’ section and selecting 26 View Form 26AS.

Every taxpayer should carefully examine their certificate for tax deduction at source against Form 26AS while filing income tax.

This will ensure that all taxes collected from their salary. Income from interest, etc. are duly paid to the Government of India, and logged against their PAN.

They will also have to see if the TDS certificate and all the values displayed in Form 26AS match with each other; Otherwise they will not be able to claim input tax credit on the total tax deducted.

3. Visit the e-filing website

Visit the site www.incometaxindiaefiling.gov.in .

4. Register or Login to e-file your returns

In case you have registered yourself on the portal earlier, click on the ‘Login Here’ button.

In case you have not registered yourself on the portal, click on the ‘Register Yourself’ button.

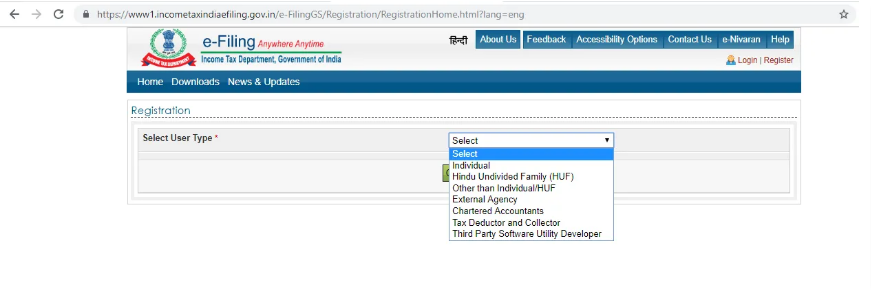

5. Select the User Type

To register yourself with the Income Tax Department, you must first select your ‘user type’. Choices available to you include Individual, Hindu Undivided Family (HUF), Other than Individual / HUF, External Agency, Chartered Accountant, Tax Deadtor and Collector and Third-Party Software Utility Developer.

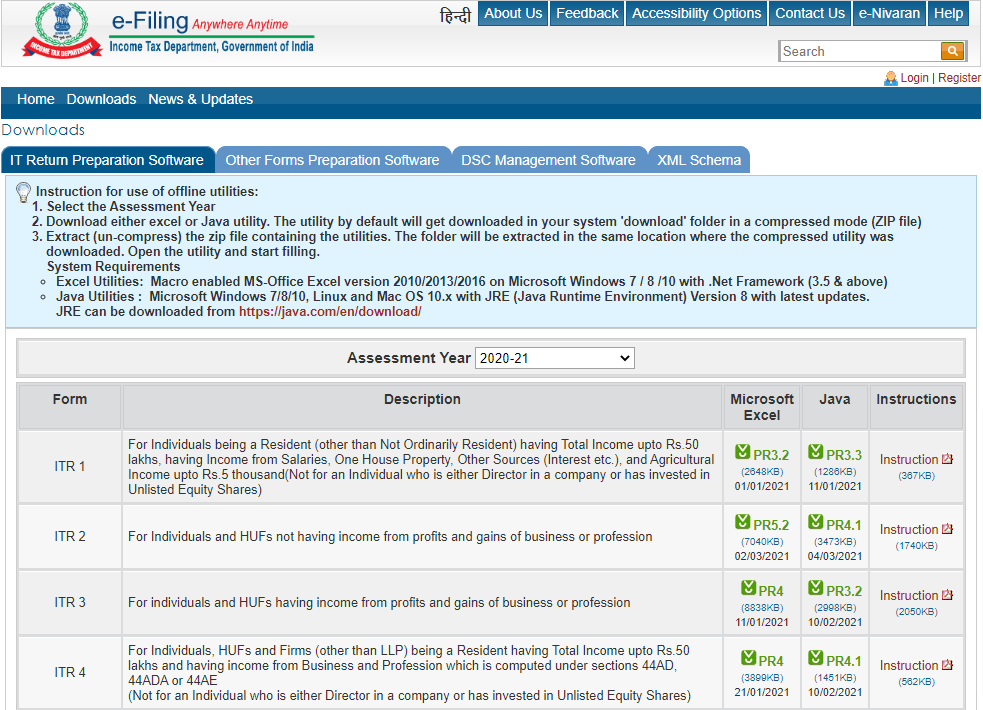

6. Download ITR utility from Income Tax Portal

Choose the assessment year and download the offline utility software, i.e. Microsoft Excel or Java utility based on your preference.

7. Fill in your details in the Downloaded File

On downloading the offline utility, fill in the relevant details of your income, and check the tax or refund payable as per the calculation of the utility. Income tax challan details can be filled in the downloaded form.

8. Validate the Information Entered

You can see some buttons on the right side of the downloaded form. Click on the ‘ate valid’ button to fill all the required information.

9. Convert the file to XML Format

After the validation, click on the ‘Generate XML’ button. This will convert your file in to an XML file.

10. Upload the XML file on the Income Tax Portal

Now, log in to the income tax e-filing portal and click on the ‘e-File’ tab to select the ‘Income Tax Return’ option.

Provide the required details such as PAN, assessment year, ITR form number, and submission mode. Remember to select ‘XML Upload XML’ from the drop down corresponding to ‘Field Name Mode Submission Mode’.

After that, Click on the ‘Continue’ button and upload the XML file which you have saved in your computer.

Click on the ‘Submit’ button and select a mode of verification from the list – Electronic Verification Code (EVC), Aadhaar OTP, and so on.