What is GSTIN

GSTIN stands for Goods and Services Tax Identification Number. GSTIN a 15-digit PAN-based Unique Identification Number allotted to every registered person under GST.

This GST number India is given to the GST taxpayer along with the GST registration certificate. The GSTIN number functions just like the TIN allotted for payment of VAT or Value Added Tax.

Under the GST regime, all registered taxpayers consolidated into a single platform for compliance and administration purposes and assigned registration under a single authority.

Unlike the previous indirect tax regime. Where multiple registration numbers existed for different laws like excise duty, service tax, and VAT, this is a single registration number under GST-GSTIN.

There can be multiple GSTINs for an individual. Being an assessee under the Income Tax Act for each State or Union Territory from which such person operates.

It becomes mandatory to obtain GSTIN when the person crosses the threshold of GST registration by registering himself under GST.

Every business operating in a state or union territory will assign a unique Goods and Services Tax Identification Number, popularly known as GSTIN.

Importance of GSTIN

GSTIN or GST number is public information. Searching GST numbers by name an important task that every business dealing with GST registered taxpayers must do to ensure the authenticity of the seller and the GSTIN or GST number used in the GST invoice.

Technology has enabled you to verify GSTIN from anywhere and anytime with a click of a button. Search the GST number before making a deal.

You can partially verify the GSTIN or GST number at first glance whether the seller’s PAN number matches with the digits between 3 and 10 in the GSTIN.

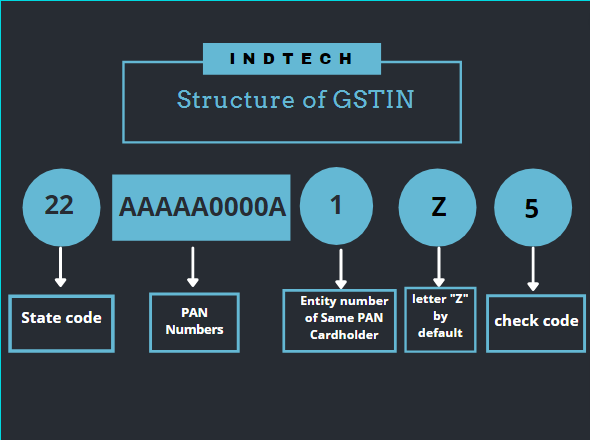

Structure of GSTIN

Under the GST regime, each taxpayer is assigned a State + PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN).

Here is a format break-down of the GSTIN:

- The first two digits represent the state code as per Census of India 2011. Each state has a unique code. for example,

- The state code of Delhi is 07

- The state code of Uttar Pradesh is 09

- The next 10 digits are the PAN numbers of the person or the business entity.

- The thirteenth digit is based on the number of registrations done by the firm within a state under the same PAN.

- The fourteenth digit will be the letter “Z” by default

- The last digit to detect errors is called the check code and can be represented by any number of alphabets.

How to apply for GSTIN?

It is part of the GST registration process. Once the application is approved by the GST officer, a unique GSTIN is allotted to the dealer.

There are two ways to register for GST:

2. via GST Seva Kendra set up by the Government of India

This way to register for GSTIN is by directly visiting the GST Seva Kendra. The government has set up a number of Seva Kendras or “Seva Kendras” to facilitate all things related to GST and for the ease of taxpayers.

The government has set up service centers to facilitate migration to GST for many taxpayers. These taxpayers are those people who do not have or do not know how to use the online portal of GST.

How to Verify GSTIN?

There are many firms that present invalid and fake GSTIN numbers just to charge extra money and evade taxes under GST rules.

Firstly, as per the rules, every service provider/merchant who collects GST from their customers has to print their GSTINs numbers on all their produced invoices.

However, if you have any doubts you can check the validity of the GSTINs provided to you.

It is quite easy to check the validity of the GSTINs number; Simply follow the below steps for GST verification:

- Go to the GST verification portal https://www.gst.gov.in/

- You will see the “Search Taxpayer” option on the menu bar

- Enter the GSTIN you want to verify in the search box along with the captcha code provided to you.

- If the given GSTINs is a valid GST registered business as per the GST rules, the following details will be in front of you in seconds

- GSTIN Status

- Registration Date

- Type of Business Structure: Company, Sole proprietorship

- Type of Taxpayer. Regular Taxpayer, Composition, SEZ unit

- If the GSTINs entered is invalid, the website will display a message saying “Error”

Benefits of getting a GSTIN

- Legal recognition of the business entity as a supplier of goods or services. This, in turn, helps in attracting more customers and increasing the business.

- You will be more competitive than small businesses as buying from them will ensure input credit.

- A person who has GSTINs can take input credit on his purchases and input services

- No restriction on interstate sales (will treat as casual taxable persons). Thus, the potential market for SMEs reaches the next level.

- You can either register on e-commerce sites or open your own e-commerce website. It will re-enlarge the scope of business for a registered person

- GST registration will ensure that your business compliant (as most returns are automated). This will improve your firm’s GST rating and help in promoting business.

How is GSTIN different from GSTN?

Do not get confused between GSTIN and GSTN. GSTIN is a tax registration number under GST. Whereas, the Goods and Services Tax Network (or GSTN) is the organization that manages the entire IT system of the GST Portal.

This portal will use by the Government of India to track every financial transaction and will provide all services to the taxpayers – from registration to tax filing and maintenance of all tax details.

READ ALSO : GST Return: How to File GST Return Online

READ ALSO : GST on Gold? Impact on Gold Jewellery Prices